India’s EV story is accelerating, but the headline numbers hide a problem: mainstream adoption is still constrained by price, running costs, and everyday practicality. For millions of city commuters who want something cheaper than a hatchback, easier to park than a car, and safer than a two-wheeler, the market needs a new category: ultra-compact, extremely affordable electric runabouts built for short urban trips. Enter the Citroën Ami — a purpose-built micro-EV that, on paper, ticks many of the boxes Indian cities demand. Here’s why the Ami matters, how it stacks up against the closest Indian rival (MG Comet), and whether it can revive Citroën’s fortunes in India.

Quick snapshot: Citroën Ami’s Specs

- Type: ultra-compact 4-wheeler / quadricycle.

- Battery: ~5.5 kWh.

- Range: about 70–75 km (WLTP) — intended for short daily runs, not highway trips. (citroen.co.uk)

- Top speed: ≈45 km/h — city speeds only. (citroen.ie)

- Size: ~2.41 m long, 1.39 m wide — takes up roughly half a parking spot. (citroen.co.uk)

- Price (Europe): entry-level pricing historically in the low-€6k–€8k range (basis for “ultra-affordable” positioning). Recent Citroën updates show base pricing still under €8k in Europe. (electrive.com)

These aren’t family-car specs — they’re urban-mobility specs. The AMI exists to replace short car trips, taxis and some two-wheelers inside cities.

Why India needs tiny EVs like Citroën Ami

- Trip profile match: A large share of Indian urban trips are under 10–15 km. A 70-75 km city range is more than sufficient for daily commutes, groceries and short errands.

- Cost sensitivity: Buying power is the primary blocker for EV adoption. A genuinely low-price electric vehicle (not a down-spec SUV) could convert price-driven buyers.

- Parking & congestion: Ultra-compact vehicles free up road and parking space, easing a chronic pain point in Indian metros.

- Safety upgrade vs two-wheelers: For low-speed city trips, a small enclosed 4-wheeler is objectively safer than a motorcycle/scooter.

Put simply: India doesn’t always need expensive long-range EVs. It needs affordable, pragmatic urban EVs — and that’s the AMI’s pitch.

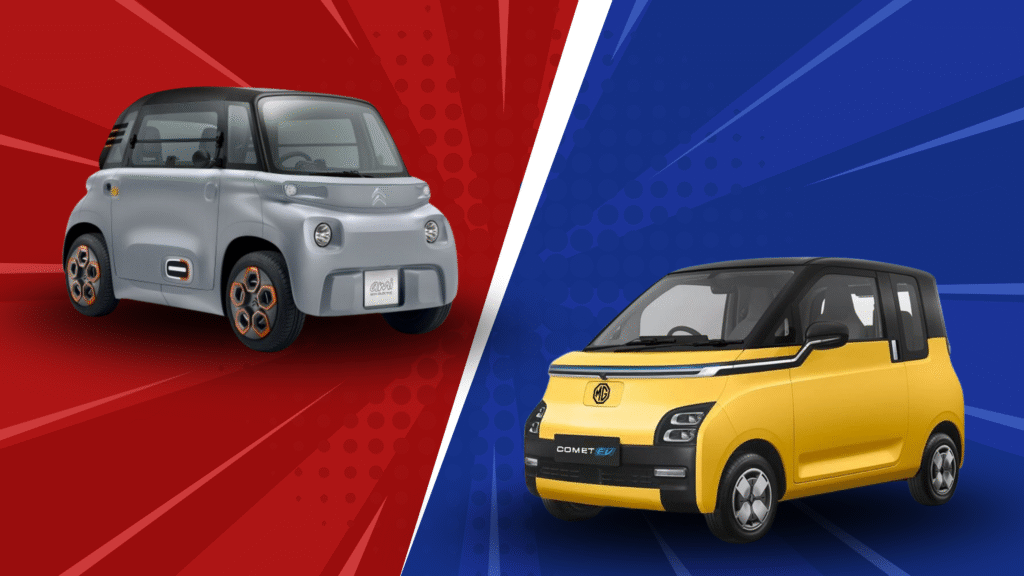

Citroën Ami vs MG Comet — a practical comparison

MG Comet is the closest Indian commercial micro-EV challenger: a compact, 4-seat electric vehicle positioned for city buyers. Below is a crisp comparison of the two (load-bearing facts cited):

| Aspect | Citroën Ami | MG Comet (India) |

|---|---|---|

| Intended use | Urban micro-mobility, two occupants, short runs. (citroen.co.uk) | Urban small car — 4 seats, family-oriented micro-EV. (MG Motor India) |

| Battery / Range | ~5.5 kWh → ~70–75 km WLTP. (licarco.com) | ~17.3 kWh → ~200–230 km (claim varies by cycle). Substantially higher range. (MG Motor India) |

| Top speed | ~45 km/h (quadricycle limited). (citroen.ie) | Capable of normal city speeds (higher than AMI). (MG Motor India) |

| Positioning / Price | Ultra-budget micro-EV in Europe (~€6–8k). Potential to be India’s most affordable EV if localized. (carwow.co.uk) | Priced in India roughly ₹5–10 lakh (BaaS options lower upfront). Marketed as India’s affordable 4-seater EV. (MG Motor India) |

| Practicality | Extremely compact — best for solo/couple trips, last-mile; parking-first design. (citroen.co.uk) | More versatile: full 4 seats, larger battery → usable for longer intra-city trips/family use. (MG Motor India) |

| Strategic fit (India) | Could conquer hyper-price-sensitive, single-user urban segment if priced & certified locally. | Already launched and operating in Indian market with dealer+service network. (MG Motor India) |

Takeaway: MG Comet beats Ami on range and seating versatility. Ami wins on lowest possible cost, smallest footprint, and absolute affordability, which opens a different consumer segment — very short-trip urban users who currently choose two-wheelers or cabs.

How Ami could be a game changer for Citroën India

Citroën’s India chapter hasn’t met expectations so far; sales and market presence are modest relative to rivals. But AMI gives Citroën three fast-acting advantages if launched and localized correctly:

- Own a distinct niche: Ami doesn’t compete directly with hatchbacks — it creates a new low-cost EV lane. That differentiation is brand gold in a crowded entry-level market. (Citroën’s broader India results have been weak; chasing the same segments won’t help.) (Autocar Pro)

- Low barrier to scale: The Ami’s simple architecture and small battery make local assembly (or CKD/kitting) and low capex easier than full-size EVs — helping Citroën offer very aggressive pricing. (licarco.com)

- Urban fleet & sharing potential: The Ami fits car-sharing, last-mile fleet, and micro-rental models (airport shuttles, campus fleets). Fleet deals could rapidly boost volumes and visibility.

- Marketing halo effect: A successful Ami can rebuild dealer traffic and brand recognition, giving Citroën a platform to upsell larger models later.

In short: the Ami is a product-market fit experiment India cries out for. If Citroën plays price, distribution, and service smartly, it can flip poor brand perception by showing it understands Indian urban mobility.

What Citroën must do to make it work in India (practical checklist)

- Local assembly & aggressive pricing: Bring duties and localisation into play to hit sub-₹3–4 lakh price points (or offer battery-rental models) to beat two-wheelers + taxi alternatives on total cost.

- Regulatory alignment & safety: Work with regulators to certify the Ami under the right category (and meet crash/safety norms expected by Indian buyers).

- After-sales & micro-service network: Even ultra-affordable buyers need trust — subscription service packages, battery warranties, and micro-service centres.

- Right marketing & use cases: Target delivery fleets, last-mile operators, students, and urban couples — not traditional family buyers.

- Optional add-ons: Sunroof/awning, small AC for hot climates, dust-proofing, and a slightly higher spec variant with higher top speed for tier-2 cities.

Challenges — the blunt truth

- Perception & acceptance: Indians expect a “car” to have certain speed/range/space. The Ami will be dismissed unless pitched as a purposeful urban runner, not a truncated car.

- Competition from cheap 4-seat EVs: Models like MG Comet offer full-car experience at accessible prices; Ami must undercut by being meaningfully cheaper. (MG Motor India)

- Regulatory & safety expectations: Compliance costs and certification could raise price. Citroën must balance regulation with cost discipline.

Key regulatory & market factors in India

To judge suitability we need to check how these features align with India’s regulatory & market realities.

- Quadricycle classification: India does allow “quadricycles” (4-wheelers, small, lightweight, under certain size and power limits). The government has rules for their emission norms (BS-VI), dimensions, weight, etc. (mint)For example, the vehicle must not weigh more (curb weight) than certain limits; engine size / power / emissions must be under thresholds. (mint)

- Road safety & crash norms: India’s safety regulations for small vehicles / quadricycles are less stringent than for full sized cars, but still there are concerns around crash protection, braking, structural safety, etc. The Ami is a minimal vehicle, so safety in crashes (especially with larger vehicles) could be a concern.

- Speed and traffic conditions: The Ami’s top speed (~45 km/h) is adequate for slow urban roads, but on many roads in Indian cities speed and traffic are more mixed, with faster traffic, and roads often in variable condition. Keeping up with traffic flow, overtaking, acceleration might be challenging (or risky) in many settings.

- Cost and import/local manufacturing

- If imported, cost will be high (import duties, taxes, shipping). That can make “cheap small EV” more expensive.

- If built locally, maybe cost could be lower, but need appropriate supply chain, battery, EV incentives, etc.

- Also, charging infrastructure: while India is improving, home charging, public charging, etc., availability may matter.

- Use-case: The Ami is well suited for very short urban trips, last-mile connectivity, neighborhoods, possibly car-sharing, or for people who don’t need speed or long range. It would be less suitable for longer commutes, highways, rugged roads, etc.

- Regulatory acceptance & licensing: In Europe, Ami is classed so that young people or people with minimal license or lower licensing requirements may drive it. In India, licensing norms are more rigid. Drivers license, registration, insurance, etc., would need to comply with Indian laws. It might require regulatory changes or specific classification approval to allow Ami as a legal “quadricycle” in local categories. India has allowed quadricycles, but as of now there have been very few active ones in market, as noted. (mint)

Pros & Cons: Is it suitable for India?

| 👍 Advantages | 👎 Disadvantages / Challenges |

|---|---|

| Very compact → easy parking; good for dense city traffic. | Low top speed, limited safety in mixed-traffic with faster vehicles. |

| Zero tailpipe emissions, cheap running cost. | Limited range (~70 km) → not useful if daily distances are higher or for unexpected trips. |

| Simple charging (220 V socket, small battery) | Poor performance or stability on bad roads; safety and crash norms might be insufficient. |

| Potentially lower cost if subsidised / produced locally | Cost could still be high (import taxes) and acceptance by consumers questionable (they expect more features, safety, power). |

Regulatory & Market Barriers

- India has defined quadricycle rules, but uptake has been low. (mint)

- Safety standards, homologation, certification might require modifications of the Ami.

- Consumers expect certain minimum features (AC, safety features, road presence). Ami’s minimal interior might be seen as too spartan.

- After sales service, spare parts, charging infrastructure will be important.

Conclusion — who should consider an Ami in India?

If Citroën localizes the Ami and prices it as a genuine ultra-budget urban EV, it will appeal to:

- Solo commuters and app-based delivery riders seeking a step up from two-wheelers.

- Students, campuses, gated communities and corporate fleets for short-trip mobility.

- Urban buyers who value parking & running cost over highway capability.

For Citroën, the Ami is not a silver-bullet rescue, but it is a low-risk, high-visibility play that can reset the brand’s India narrative — if they price it sharply, build the right after-sales promise, and position it honestly as a city-only, ultra-affordable electric runner. If they get those levers right, the AMI could become a small car with a very big strategic ripple.

Sources & further reading

- Citroën Ami official pages and specs. (citroen.co.uk)

- Citroën Ami background & production details (Wikipedia / market writeups). (Wikipedia)

- MG Comet official India page & pricing/news. (MG Motor India)

- Reporting on Citroën’s India performance and Stellantis strategy. (Autocar Pro)